Ever filled a prescription and been shocked by the price-even though your insurance was supposed to cover it? That’s not a mistake. It’s likely your drug landed in a higher tier than you expected. Insurance formulary tiers are the hidden system that decides how much you pay for your meds. Understanding them isn’t just helpful-it can save you hundreds a year.

What Is a Formulary, Anyway?

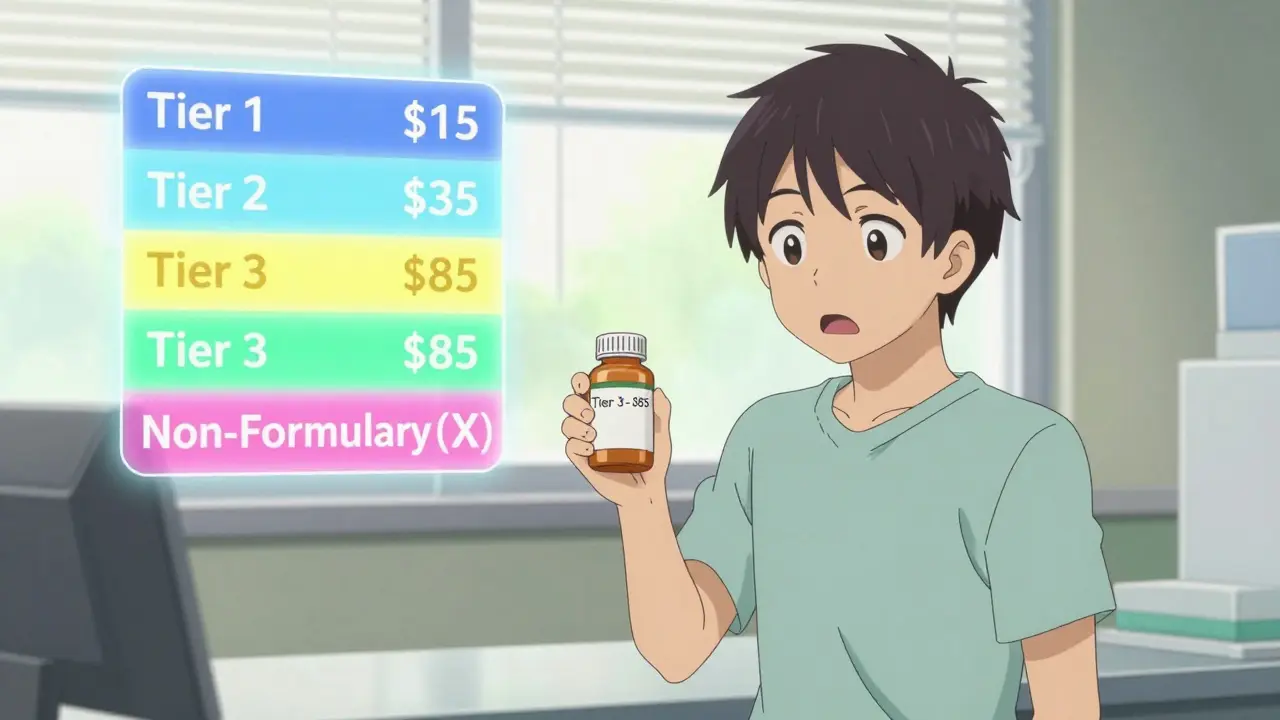

A formulary is simply the list of drugs your health plan will pay for. Think of it like a menu. Not every medicine is on it. And even if it is, the price you pay changes depending on which tier it’s in. These tiers are set by your insurance company and its Pharmacy Benefit Manager (PBM)-the middlemen who negotiate drug prices behind the scenes.Most plans use three to five tiers. The lower the tier, the less you pay. The higher the tier, the more you shell out. Some drugs aren’t covered at all-that’s the non-formulary list. And here’s the kicker: your plan can change these tiers at any time, often with little notice.

Tier 1: The Cheap Stuff

Tier 1 is where you want to be. This tier is mostly filled with generic drugs that have been around for years. They’re proven, safe, and dirt cheap. In 2023, the average copay for a 30-day supply of a Tier 1 drug was between $0 and $15. Some plans even make them free.Why are they so cheap? Because generics don’t have the research and marketing costs that brand-name drugs do. Plus, insurers get big discounts from manufacturers. If you’re on blood pressure meds, diabetes pills, or antidepressants, chances are there’s a generic version in Tier 1.

Example: Lisinopril (for high blood pressure) is a Tier 1 drug in almost every plan. It costs about $4 a month. The brand version, Zestril,? Often in Tier 3 or higher. Same active ingredient. Same effect. Different price tag.

Tier 2: The Preferred Brands

Tier 2 is where you’ll find brand-name drugs that your plan still likes enough to cover at a lower cost. These aren’t generics, but they’ve been negotiated down through rebates or have fewer alternatives. Copays here usually run $20 to $40 for a 30-day supply.Insurers prefer these drugs because they’ve been shown to work just as well as pricier options-or because the manufacturer gave them a sweet deal. If your doctor prescribes a brand-name drug that’s on Tier 2, you’re getting a good deal.

Example: Metformin is generic and Tier 1. But if your doctor prescribes Glucophage (the brand name), it might still be in Tier 2 because it’s widely used and trusted. Some plans put newer, slightly more expensive versions of older drugs here too.

Tier 3: The Expensive Brands

Tier 3 is where things start to hurt. This tier includes brand-name drugs that have cheaper alternatives available. Insurers don’t discourage them entirely-they just make you pay more. Copays here are typically $50 to $100 per month.Why are these drugs here? Often because the manufacturer didn’t offer a big enough rebate, or there’s a generic or preferred brand that works just as well. But sometimes, there’s no real alternative. That’s when you’re stuck.

Example: Amlodipine (generic) is Tier 1. Norvasc (brand) is Tier 3. Same drug. Same effect. But Norvasc costs five times more. Your plan wants you to pick the generic.

Here’s the real issue: if your doctor insists on a Tier 3 drug because they think it’s better, you might not know until you get to the pharmacy. That’s why checking your formulary before your appointment matters.

Tier 4 and 5: Specialty Drugs

Not all plans have five tiers, but if yours does, Tier 4 and 5 are for specialty drugs. These are expensive, often injectable or oral medications for complex conditions like cancer, multiple sclerosis, rheumatoid arthritis, or rare diseases.Instead of a flat copay, you usually pay a percentage of the drug’s cost-called coinsurance. That’s often 25% to 50%. A single month’s supply can cost $1,000 to $10,000. Your out-of-pocket? $250 to $5,000.

Example: Humira (for autoimmune diseases) is often in Tier 5. The list price? Around $7,000 a month. With 33% coinsurance, you pay $2,300. Even with Medicare’s new $35 insulin cap, most specialty drugs have no such protection.

These tiers are growing fast. In 2023, 68% of commercial plans put specialty drugs in Tier 4 or 5. That’s up from 52% in 2015. And there’s no sign of slowing down.

Non-Formulary: Not Covered at All

Non-formulary drugs aren’t on your plan’s list. Period. You pay 100%. No discount. No copay. No help.Why? Maybe the drug is new and hasn’t been reviewed yet. Maybe it’s too expensive. Maybe there’s a cheaper, equally effective alternative. Or maybe the manufacturer refused to negotiate.

Example: A brand-new migraine drug that just hit the market might be non-formulary for six months. Or a drug that’s been around but is rarely prescribed because better options exist.

If your drug is non-formulary, you have two options: pay full price, or ask for an exception. That’s a formal request-usually from your doctor-to get it covered anyway. It takes about a week. Approval isn’t guaranteed, but it happens more often than you think.

Why Do Tiers Exist?

You might wonder: why make it so complicated? Why not just cover everything?Because drug prices are insane. The U.S. spent $621 billion on prescriptions in 2022. Without tiers, premiums would be unaffordable. Tiers push patients toward cheaper, effective drugs. That saves insurers money-and can save you money too.

But here’s the catch: it’s not always about cost-effectiveness. It’s about rebates. PBMs get kickbacks from drugmakers to put their products in lower tiers. That’s why two identical drugs can be in different tiers on different plans. One manufacturer paid more.

According to the American Pharmacists Association, only 32% of plans explain how they assign tiers beyond “generic vs. brand.” That’s not transparency. That’s a black box.

How to Navigate This System

You don’t have to guess. Here’s how to take control:- Check your formulary before you fill a script. Every plan has a downloadable list-usually 100+ pages. Search for your drug by name.

- Ask your doctor: “Is there a generic or Tier 1 alternative?” They might not know unless you ask.

- Use tools: Medicare’s Plan Finder, Humana’s Drug Cost Finder, or your insurer’s online portal. They show real-time copays.

- Know the difference: Copay = fixed fee. Coinsurance = percentage of price. Tier 3 might be a $75 copay. Tier 5 might be 30% of $5,000-that’s $1,500.

- Request exceptions: If your drug is in a high tier and you need it, your doctor can file an appeal. Many are approved, especially if there’s no safe alternative.

- Watch for changes: Plans can change tiers quarterly. You might get a letter. You might not. Check your formulary every January and July.

What’s Changing in 2026?

The Inflation Reduction Act of 2022 changed things. Insulin is now capped at $35 a month for Medicare patients-no matter the tier. That’s huge.Also, Medicare’s new catastrophic coverage phase (starting in 2024) means once you hit a certain spending threshold, your out-of-pocket for specialty drugs drops dramatically. About 1.4 million people will save an average of $800 a year.

Some PBMs are testing “value-based” tiers-where drugs are ranked by how well they work, not just how cheap they are. That’s a step forward. But it’s still early.

One thing’s certain: tiers aren’t going away. But pressure from patients, lawmakers, and drugmakers might simplify them. By 2027, experts predict average tier numbers will drop from 4.2 to 3.5.

Bottom Line

Formulary tiers aren’t meant to confuse you. But they do. And that’s the problem.They’re designed to save money-for insurers and, sometimes, for you. But if you don’t know how they work, you’re flying blind. A Tier 3 drug could cost you $100 a month. The same drug in Tier 1? $15. That’s $1,000 a year. That’s a vacation. That’s groceries.

Don’t wait until the pharmacy counter to find out. Check your formulary. Ask questions. Push for alternatives. And if you’re stuck with a high-cost drug, file an exception. You’ve got rights. Use them.

What does it mean if a drug is non-formulary?

A non-formulary drug isn’t covered by your insurance plan at all. You’ll pay the full price out of pocket. This usually happens when the drug is too expensive, has cheaper alternatives, or hasn’t been reviewed yet. You can ask your doctor to request an exception to get it covered, but approval isn’t guaranteed.

Can my insurance change my drug’s tier without telling me?

Yes. Insurance plans can update their formularies up to four times a year-once per quarter. They’re not required to notify you individually. Some send notices with your monthly statement; others don’t. That’s why it’s critical to check your plan’s formulary every January and July. A drug that was Tier 1 last year could be Tier 3 this year.

Why is my generic drug in Tier 2?

Even though it’s generic, your plan may still classify it as Tier 2 if it’s a newer generic, has limited competition, or the manufacturer didn’t offer a strong rebate. Sometimes, a different generic version of the same drug is in Tier 1. Ask your pharmacist if there’s a lower-cost alternative with the same active ingredient.

Do Medicare and private plans use the same tiers?

Medicare Part D plans almost always use four tiers: Tier 1 (lowest-cost generics), Tier 2 (preferred brands), Tier 3 (non-preferred brands), and Tier 4 (specialty drugs). Commercial plans vary more-some use three tiers, others five. Medicare doesn’t use coinsurance for most drugs (except specialty), while private plans often do. Always check your specific plan’s formulary.

How do I get a drug moved to a lower tier?

You can’t directly change the tier. But your doctor can file a formulary exception request if they prove the drug is medically necessary and there’s no safer or equally effective alternative in a lower tier. Many requests are approved-especially for chronic conditions. The process usually takes 5-7 business days. Keep copies of all paperwork.

Are there tools to help me find out my drug’s tier?

Yes. Medicare beneficiaries can use the Medicare Plan Finder tool. Private plan members should check their insurer’s website-most have a drug cost lookup tool. Third-party sites like GoodRx also show estimated copays based on your zip code and plan. Always verify with your insurer directly, as third-party tools aren’t always accurate.

Why do two plans cover the same drug at different tiers?

Because each plan negotiates separately with drug manufacturers. One insurer might get a bigger rebate for a brand-name drug and put it in Tier 2. Another might get nothing and put it in Tier 3. It’s not about the drug’s quality-it’s about money. That’s why switching plans can change your out-of-pocket costs dramatically, even if you’re on the same meds.

What if I can’t afford my Tier 5 drug?

You have options. First, ask your doctor about patient assistance programs offered by the drugmaker. Many offer free or discounted drugs to low-income patients. Second, contact the Patient Advocate Foundation-they help people navigate high-cost meds and can connect you with grants. Third, explore state pharmaceutical assistance programs. In Australia, the PBS helps, but in the U.S., you’ll need to rely on nonprofit and manufacturer aid.

Graham Holborn

Hi, I'm Caspian Osterholm, a pharmaceutical expert with a passion for writing about medication and diseases. Through years of experience in the industry, I've developed a comprehensive understanding of various medications and their impact on health. I enjoy researching and sharing my knowledge with others, aiming to inform and educate people on the importance of pharmaceuticals in managing and treating different health conditions. My ultimate goal is to help people make informed decisions about their health and well-being.