The U.S. Food and Drug Administration (FDA) doesn’t approve biosimilars the same way it approves generic pills. That’s because biosimilars aren’t simple chemical copies-they’re complex proteins made from living cells, used to treat cancer, rheumatoid arthritis, diabetes, and other chronic diseases. Unlike generics, which are chemically identical to their brand-name counterparts, biosimilars are highly similar but not exact replicas. This difference changed everything about how the FDA evaluates them.

Why Biosimilars Are Different from Generics

A generic version of a drug like ibuprofen is made by mixing the same chemicals in the same way, every time. It’s predictable. A biosimilar, however, is grown in living cells-usually yeast or Chinese hamster ovary cells. Tiny changes in temperature, nutrients, or manufacturing conditions can alter the final product. Even a small shift in sugar molecules attached to the protein can affect how the drug works in the body. That’s why the FDA doesn’t just check a pill’s chemical formula for biosimilars. Instead, they demand hundreds of tests: mass spectrometry to analyze molecular structure, chromatography to separate protein variants, and bioassays to measure biological activity. The goal isn’t to match the reference biologic down to the last atom-it’s to prove the two products behave the same way in humans.The 2025 FDA Guidance: A Major Shift

On October 29, 2025, the FDA released its most significant update to biosimilar rules since the Biologics Price Competition and Innovation Act (BPCIA) passed in 2010. The new draft guidance, titled Scientific Considerations in Demonstrating Biosimilarity to a Reference Product: Updated Recommendations for Assessing the Need for Comparative Efficacy Studies, removed the routine requirement for full-scale clinical efficacy trials. Before this, companies had to run expensive, multi-year studies comparing the biosimilar to the original biologic in thousands of patients to prove it worked just as well. Now, if three conditions are met, those trials may not be needed at all:- The reference product and biosimilar are made from the same type of cell line and are highly purified

- The link between the molecule’s structure and its clinical effect is well understood

- A pharmacokinetic (PK) study-measuring how the drug moves through the body-can be done and is meaningful

Interchangeability: The Big Controversy

Interchangeability is the holy grail for biosimilars. It means a pharmacist can swap the biosimilar for the brand-name drug without asking the doctor. In 34 states, laws still require prescriber approval for substitution-creating confusion and delays. The FDA’s new stance is bold: Commissioner Marty Makary said at the GRx+Biosims 2025 conference, “Every biosimilar should have the designation of interchangeable.” He called interchangeability “a legislative term, not a scientific term.” That’s a problem. The law says interchangeability requires extra proof-specifically, that switching back and forth between the biosimilar and reference product doesn’t increase risk. The FDA used to require “switching studies” to prove this. Now, they’re dropping that requirement for many products. Two denosumab biosimilars (Enoby and Xtrenbo) received interchangeability approval in October 2025, but only after submitting data showing no increased immunogenicity or safety issues after multiple switches. Critics worry this move could erode trust. Dr. Robert Popovian, former Chief Science Officer at PhRMA, warned that removing the scientific bar for interchangeability might make doctors hesitant to prescribe biosimilars-even when they’re safe.

How the FDA Actually Reviews a Biosimilar

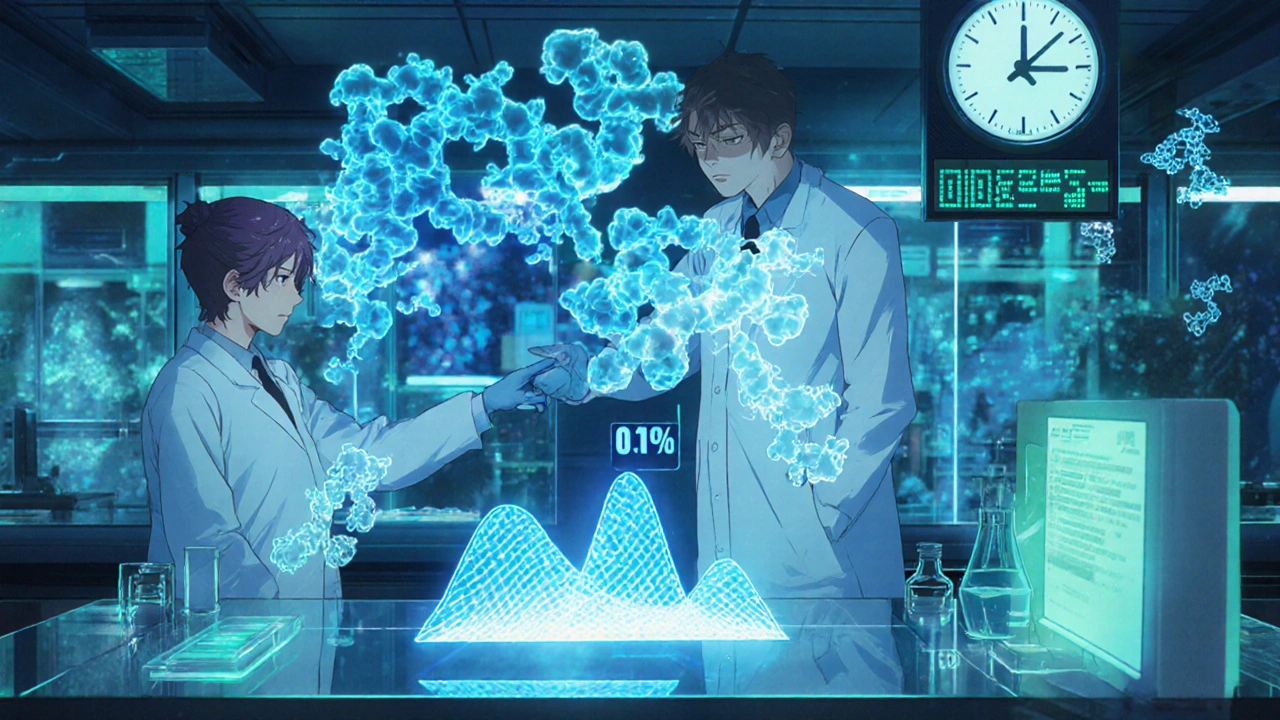

The process starts long before a company files an application. Most developers meet with the FDA early to agree on a development plan. Then comes the Biologics License Application (BLA) under Section 351(k) of the Public Health Service Act. Here’s what they must prove:- Analytical studies: Over 200 quality attributes are compared. Think molecular weight, charge variants, glycosylation patterns, and protein folding. The FDA uses advanced tools like liquid chromatography-mass spectrometry (LC-MS) to detect differences as small as 0.1%.

- Pharmacokinetic (PK) and pharmacodynamic (PD) studies: These measure how fast the drug enters the bloodstream and how it affects the body-usually in healthy volunteers. For many drugs, this alone is enough to prove similarity.

- Immunogenicity assessment: Does the biosimilar trigger unwanted immune reactions? This is critical for biologics, which can cause antibodies that neutralize the drug or cause allergic reactions.

- Toxicity and safety data: Even if efficacy studies are waived, the FDA still needs safety data from at least one clinical trial, often focused on side effects.

Who’s Winning in the Biosimilar Race?

As of late 2025, the FDA has approved 76 biosimilars. But the market is dominated by a few big players:- Sandoz: 17 approved biosimilars

- Pfizer: 12

- Amgen: 10

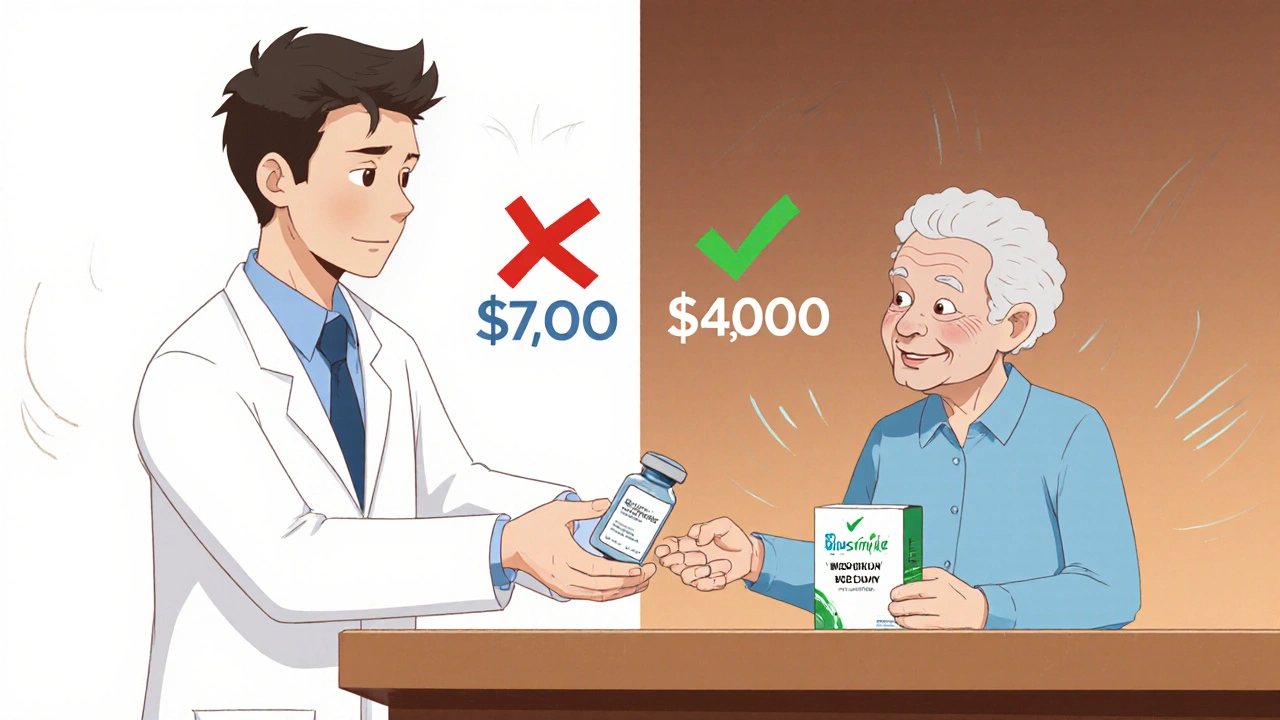

Real-World Impact: Savings and Patient Stories

Mayo Clinic reported a 37% drop in biologic drug spending after switching to biosimilars for cancer treatments-saving $18 million a year. The FDA estimates biosimilars could save the U.S. healthcare system $250 billion over the next decade. Patient experiences are mixed but mostly positive. A September 2025 Arthritis Foundation survey of 1,247 users found 78% were satisfied with their biosimilar’s effectiveness. But 41% had initial fears about safety. Most of those fears disappeared after talking to their doctor. On Reddit’s r/pharmacy, a November 2025 thread on switching to a biosimilar for rheumatoid arthritis had 87 comments. Sixty-three percent said their symptoms stayed the same. Twenty-two percent noticed minor differences-mostly injection site redness or fatigue. No one reported serious safety issues.Challenges Still Standing in the Way

Despite the progress, roadblocks remain:- Patent litigation: The FTC reported that 68% of approved biosimilars have been delayed by lawsuits from brand-name makers trying to extend their monopoly. These legal battles can hold back a biosimilar for years.

- State substitution laws: Even if the FDA approves interchangeability, pharmacists in some states still can’t substitute without a doctor’s OK. This creates a patchwork of rules.

- Patient awareness: Only 32% of patients know what a biosimilar is, according to the National Biosimilars Survey. Many think they’re “cheap knockoffs.” Education is lagging.

- Complex molecules: Biosimilars for antibody-drug conjugates (ADCs) or fusion proteins are harder to replicate. The relationship between structure and effect isn’t fully understood-making analytical comparisons riskier.

Graham Holborn

Hi, I'm Caspian Osterholm, a pharmaceutical expert with a passion for writing about medication and diseases. Through years of experience in the industry, I've developed a comprehensive understanding of various medications and their impact on health. I enjoy researching and sharing my knowledge with others, aiming to inform and educate people on the importance of pharmaceuticals in managing and treating different health conditions. My ultimate goal is to help people make informed decisions about their health and well-being.