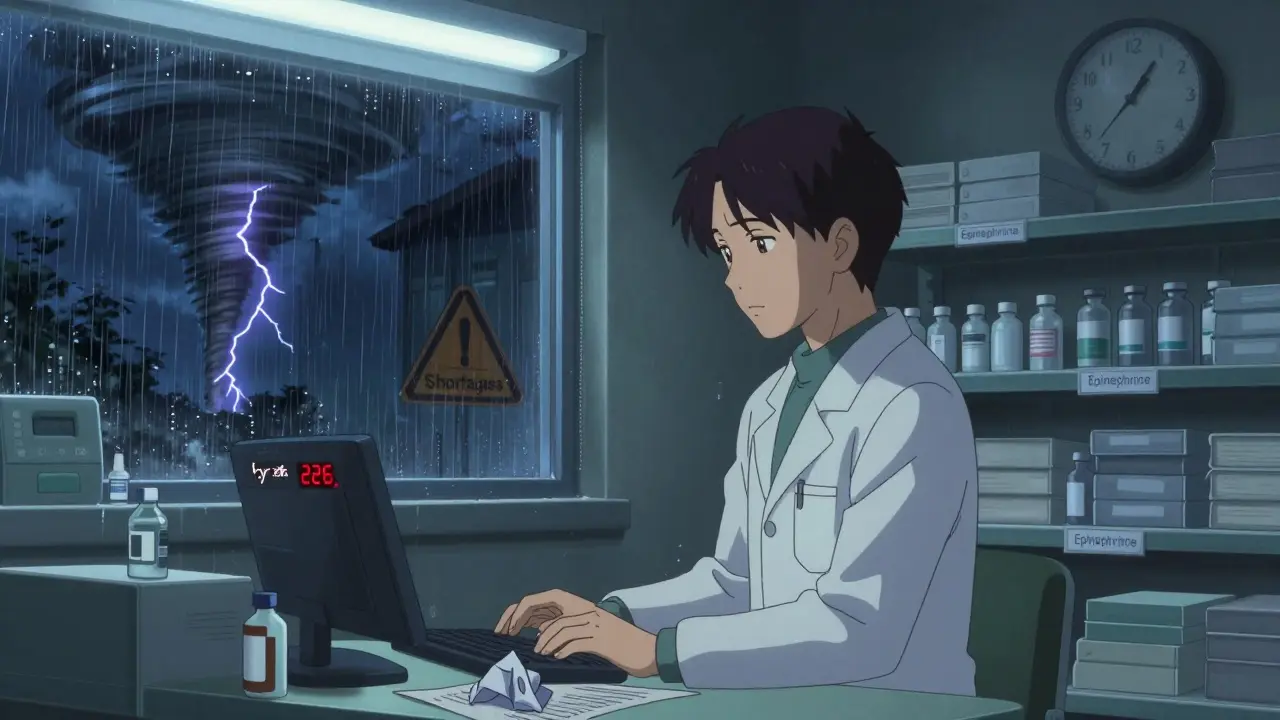

When a patient in the ICU needs a life-saving dose of epinephrine or a cancer patient requires cisplatin, and the vial isn’t there - it’s not a glitch. It’s the new reality in U.S. hospital pharmacies. As of July 2025, there were still 226 active drug shortages in the country, and nearly two-thirds of them involve sterile injectables - the exact medications hospitals depend on every hour of every day.

Why Injectables Are the First to Go Missing

Not all medications are created equal when it comes to supply chain risk. Oral pills can be stockpiled, switched out, or delayed. Injectable drugs? Not so much. They’re made in sterile environments, require complex manufacturing, and have razor-thin profit margins. Most are generic, meaning manufacturers don’t make much money off them - often just 3% to 5% profit. When a machine breaks down, a quality check fails, or a tornado hits a plant in North Carolina, there’s little financial incentive to fix it fast. About 80% of the raw ingredients for these injectables come from just two countries: China and India. A single FDA inspection failure in a facility there can shut down production for months. In February 2024, a quality issue halted cisplatin production in India, leaving U.S. hospitals without a key chemotherapy drug for over a year. Meanwhile, a tornado in October 2023 damaged a Pfizer plant, knocking out 15 essential injectables at once. These aren’t rare events. They’re becoming the norm.Hospital Pharmacies Are Taking the Brunt

Retail pharmacies might run out of a few antibiotics or blood pressure meds. But hospital pharmacies? They’re losing 35% to 40% of their essential inventory to shortages - and 60% to 65% of those are injectables. Why? Because hospitals can’t substitute them easily. A pill can be swapped for a similar one. But an IV medication? Bioavailability, dosing, and delivery method matter. One wrong substitute can kill. Anesthetics? 87% in shortage. Chemotherapeutics? 76%. Cardiovascular injectables? 68%. These aren’t optional drugs. They’re used in surgeries, emergency care, and intensive treatment. Hospitals can’t just say, “Come back next week.” Patients are already here - sick, scared, and waiting. Academic medical centers report being hit 2.3 times harder than community hospitals. Why? They handle the most complex cases: organ transplants, neonatal ICUs, trauma units. These places rely on niche injectables that only one or two manufacturers make. When those manufacturers falter, there’s no backup.

The Human Cost Behind the Numbers

Behind every shortage statistic is a real person - and a stressed-out pharmacy team. Hospital pharmacists now spend an average of 11.7 hours a week just trying to find replacements. That’s more than a full workday. They’re calling distributors, checking other hospitals, begging for extra stock, and sometimes settling for less effective drugs just to keep patients alive. One nurse manager at Massachusetts General Hospital reported postponing 37 surgeries in just three months because they couldn’t get anesthetics. And it’s not just delays. It’s ethical torture. Nearly 7 in 10 hospital pharmacists say they’ve faced impossible choices: Do we give the last vial of dopamine to the 78-year-old with septic shock, or the 32-year-old trauma patient? Forty-two percent admit they’ve had to use alternatives they knew weren’t ideal - and saw worse outcomes. One pharmacist on Reddit wrote: “Running out of normal saline for three weeks straight forced us to get creative with oral rehydration for post-op patients - never thought I’d see the day.” Normal saline. The most basic IV fluid. The kind you’d expect to be on every shelf, every day. It wasn’t.Why the System Keeps Failing

The FDA has tools to track shortages, but not to stop them. Only 14% of reported shortages get resolved quickly. The Drug Supply Chain Security Act requires better tracking - but doesn’t fix the root problem: too few manufacturers, too little profit, too much risk. Just three companies control 65% of the market for critical injectables like sodium chloride and potassium chloride. One plant goes down? The whole country feels it. And while the government promised $1.2 billion in 2024 to rebuild domestic manufacturing, experts say it’ll take 3 to 5 years to see results - if it works at all. Even new policies have fallen flat. The Consolidated Appropriations Act of 2023 required earlier shortage notices. But the Government Accountability Office found it only reduced shortage duration by 7%. Meanwhile, only 12% of manufacturers use modern continuous manufacturing - a technology that could make production faster and more resilient. Most still use outdated, batch-based systems that break easily.

What Hospitals Are Doing to Survive

Hospitals aren’t sitting still. Nearly 76% have created formal shortage management committees. But only 32% say they’re properly funded or staffed. Most are run by overworked pharmacists who are already juggling med errors, staffing gaps, and regulatory audits. The best-run hospitals are doing a few things differently:- Consolidating stock of scarce items in one central location so they’re not wasted across units.

- Pre-approving therapeutic alternatives with their Pharmacy and Therapeutics Committee so swaps can happen in minutes, not weeks.

- Building direct relationships with smaller, regional distributors who might have hidden stock.

- Revising standing orders to allow oral alternatives when safe - like switching from IV fluids to oral rehydration for stable patients.

Graham Holborn

Hi, I'm Caspian Osterholm, a pharmaceutical expert with a passion for writing about medication and diseases. Through years of experience in the industry, I've developed a comprehensive understanding of various medications and their impact on health. I enjoy researching and sharing my knowledge with others, aiming to inform and educate people on the importance of pharmaceuticals in managing and treating different health conditions. My ultimate goal is to help people make informed decisions about their health and well-being.